Store Commission and Taxes

When you sell digital goods or services through app stores like Apple’s App Store or Google Play Store, the platforms charge a commission fee as compensation for hosting your app, handling transactions, and offering various tools for developers. These fees typically come in the form of a percentage of the revenue you earn from user transactions.

In addition to commission fees, taxes may also be applied, which can vary based on the user's country. The tax amount is often calculated before or after the store commission is deducted, depending on the platform.

App Store Commission Fees

Apple charges a 30% commission on sales of digital goods and services for most developers. However, developers who qualify for the Small Business Program, meaning they earn less than $1 million USD annually, pay only 15% in commission fees. The eligibility is determined by the total amount of proceeds from the previous calendar year.

App Store Small Business Program

Apple offers a reduced 15 % commission rate for developers earning less than $1 million USD per year from paid apps and in-app purchases. If you exceed this threshold, the standard 30 % rate applies for the remainder of the year. You can reapply if your revenue drops below the limit the following year.

For more details on how Apple calculates commissions and determines eligibility for the Small Business Program, check out the full explanation in the App Store Small Business Program page.

Google Play Store Commission Fees

Google Play Store also charges a 30% commission on digital goods and services. However, developers earning less than $1 million USD per year qualify for a reduced 15% commission. Furthermore, Google applies a 15% commission rate for subscriptions that renew for over a year.

Additionally, developers in certain regions can offer an alternative billing system, which could reduce the service fee to 4%.

Google Play Reduced Service Fee

Google applies a reduced 15 % service fee in the following cases:

- On the first $1 million earned each year across all your associated developer accounts.

- On auto-renewing subscriptions, regardless of total revenue.

To qualify, you need to group your associated accounts in the Play Console. Once enrolled, Google applies the reduced fee automatically.

For a complete breakdown of Google’s commission rates and eligibility for reduced fees, refer to the full explanation in the Google Play Service Fees page.

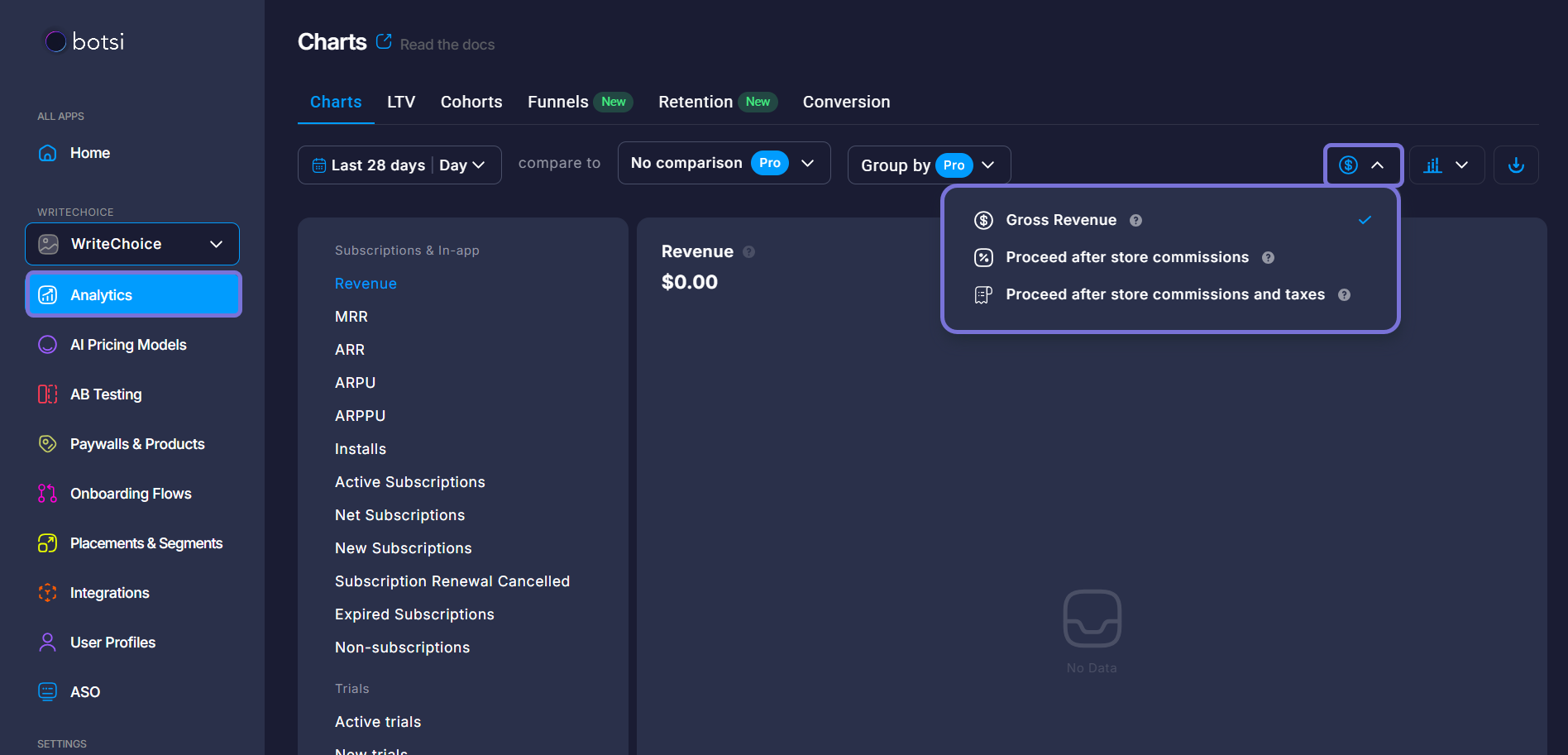

Commissions and Taxes in Botsi

In Botsi, you can track and visualize how store commissions and taxes impact your revenue within the Analytics section. When viewing your revenue data, you can select how you want it to be displayed in charts:

-

Gross Revenue: Displays the total amount before any deductions (including store commission fees and taxes).

-

Proceeds After Store Commission: Shows your revenue after store commission fees have been deducted, but before taxes are applied.

-

Proceeds After Store Commission and Taxes: Displays your net revenue after both the store commission fees and taxes have been deducted.

Note that the revenue options you select in Botsi will impact various revenue-related charts, including:

- Revenue

- MRR (Monthly Recurring Revenue)

- ARR (Annual Recurring Revenue)

- ARPU (Average Revenue Per User)

- ARPPU (Average Revenue Per Paying User)

These options provide a clearer view of how commissions and taxes affect your earnings, offering insights into your revenue performance across different charts and allowing you to analyze the impact of various commission rates and taxes over time.

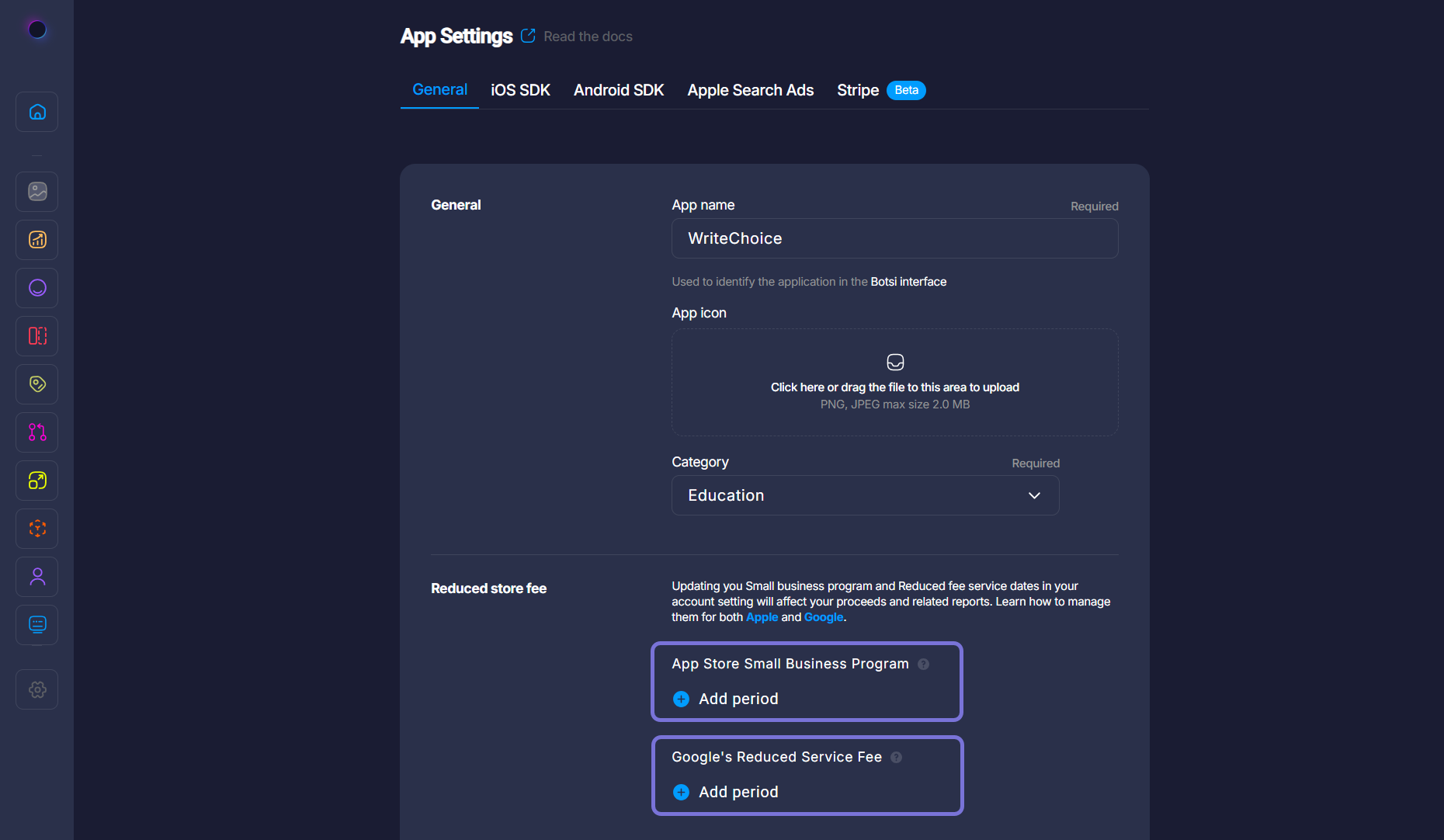

Track Store Fee Programs in Botsi

Botsi allows you to easily track and visualize your store commission adjustments based on your participation in the App Store Small Business Program and Google's Reduced Service Fee.

You can specify the start and end dates for both programs in Botsi. Once entered, your proceeds will automatically reflect the applicable commission rates during the eligible periods. The gross revenue remains unchanged, but your proceeds after store commission will be adjusted accordingly.

This ensures that your net revenue reporting aligns with the actual fee structure of each store, without manual calculations.

To add or update the periods for each program, simply navigate to the Reduced store fee section in your App Settings, and enter the period for the program(s) you are enrolled in, as shown in the screenshot below.

You can add more than one period for each program by clicking on the Add period button.